Welcome to CLÉ FRANCE

Property for sale in France, from cheap Houses to renovate right up to Luxury Dream Homes and exciting Business premises, new properties are added daily.

The quality property specialist in Normandy, Brittany, Pays de la Loire and Poitou-Charentes (North-west France). Our website is updated with new French properties for sale everyday! Sign up to our mailing list to keep up to date.

Club Clé France: Home Insurance

We have been working with Allianz Insurance since 1999 and more recently with the excellent Franck Haloche, who along with his team offer a friendly, professional service and they also speak very good English!

Whether your house in France is your main or secondary residence, an apartment or a chateau, if you're the owner or the tenant, we can insure you.

French home insurance specificities -

Contrary to arrangements in the United Kingdom where house and contents insurance are organised separately, in France they are combined in one policy which makes life very much easier and your public liability is always included.

School insurance in France -

If you have children then your assurance scolaire (school insurance) can also be included in the Household policy.

If you have a Health Top Up and a Car policy with us and decide to have a Household policy too, you can benefit from 10% off your contracts, making a considerable saving.

Please complete our Enquiry Form Below for more information.

Learn more about Healthcare Insurance in France "in plain English", download our 'PDF Guide to Healthcare in France'.

When looking for a quotation from a French insurance company, in English, that is suited to your specific health insurance needs? or just looking for advice / information about the health insurance system in France? then...

Franck and his English speaking insurance team are proud to be of service to you.

Cle France in partnership with Franck commit ourselves to providing you with excellent service you can rely on.

Franck and his team's main purpose is to establish a friendly, professional rapport with you and help you to decide what sort of insurance you need.

They can also review your current cover to ensure it still meets your needs and those of your family.

Car, House (Building and Contents Insurance), Medical Top-Up (Affordable Top Up insurance for you and your family). Allianz offer the security of a strong French business with the convenience of an English speaking insurance team, so your quotations can be provided in English.

Franck and his team look after your Insurance requirements:

Contact us and let us know your specific needs so that we can provide you with a detailed quotation suited to your family's specific requirements.

CABINET ALLIANZ

Franck Haloche.

Hi, Alex here!

At Cle France we get questions asked all the time and I don't think I can recall a question being posed that we could not answer or at the very least point our client in the right direction.

No doubt following the UK decision to leave the EU you may have a lot of questions surrounding this subject and indeed anything connected with searching for, viewing, making an offer, the buying process, owning a French property and moving to France etc.

If you have a question? I will answer it.

Simply fill out the form below and I will get back to you very soon.

Your question may have already been answered of course, check out the previously answered questions here on the 'Just Ask Alex - FAQs' Blog pages. You will find many more informative and entertaining blogs there too.

Cle France Ltd : Company No 7056720 : Registered address - 6/7 Castle Gate, Castle Street, Hertford, Hertfordshire, SG14 1HD.

For everything you need to know about French property visit www.clefrance.co.uk

The information that you give and that we obtain through you using this website may be used by this Company and by our partner companies only for purposes in connection with your use of this website and for marketing activities of this Company and partner companies. By using this site you confirm your consent to this. If you do not want to receive any marketing information from this Company and/or our partner companies then please notify us.

Club Clé France: Health Insurance Advice

We have been working with Exclusive Healthcare for many years. Ceri Hollingworth and her team offer a friendly, professional service and they also speak English; indeed Ceri is English!

France has always been renowned for the quality of its healthcare and is at the forefront of pioneering research, it has fantastic hospitals and boasts a high life expectancy rate.

One of the first steps you may wish to do is to join the Social Secuirty system, but how do you do that?.

How to join Social Security -

1. S Form

You need to get the 'S form' from health service of the your country to get benefits :

For the UK the office address is -

DWP Overseas Medical Benefits Helpline International Pension Centre

Room Tc001

Tyneview Park

Whitley Road

Newcastle upon Tyne

NE98 1BA

Tel : 0044 (0)191 218 1999

Monday to Friday 8am-5pm

2. Local CPAM office

You should register with your local CPAM office for affiliation.

It will deliver an attestation provisoire if not all the documents are available or attestation d’affiliation.

Healthcare is covered by CPAM from that day.

The following are requested :

- passport

- details of place of birth (for each person)

- proof of address in France

- date of permanent arrival in the département

- proof of having lived in France for at least 3 months

- marriage and birth certificates

- RIB ( bank details)

- Evidence of income for 12 months ( in France or elsewhere)

Then you will receive your carte vitale (green health card) which has to be handed at every health appointment. It has to be updated annually in the green box at town halls, hospitals or pharmacies.

For employed person your employer declares you to URSSAF and you must register with CPAM.

For self-employed person contact the relevant authority :

- professionals : URSSAF or Chambre de Commerce

- artisans (craftsman) : Caisse Régional des Artisans et Commerçants

- farmers : MSA.

When looking for a quotation from a French insurance company, in English, that is suited to your specific health insurance needs, or if you are just looking for advice and information about the health insurance system in France.

Please complete our Enquiry Form Below for more information.

Learn more about Healthcare Insurance in France "in plain English", download our 'PDF Guide to Healthcare in France'.

Exclusive Healthcare specialises in Health Insurance for English speaking residents in France. They offer a range of policies designed to meet the needs of people moving to France at every stage and in all circumstances.

Ceri and her English speaking insurance team are proud to be of service to you.

Contact us and let us know your specific needs so that we can provide you with a detailed quotation suited to your family's specific requirements.

Ceri HOLLINGWORTH

International Insurance Advisor.

For everything you need to know about French property visit www.clefrance.co.uk

Club Clé France: MMS Groundworks & Septic Tank Installations

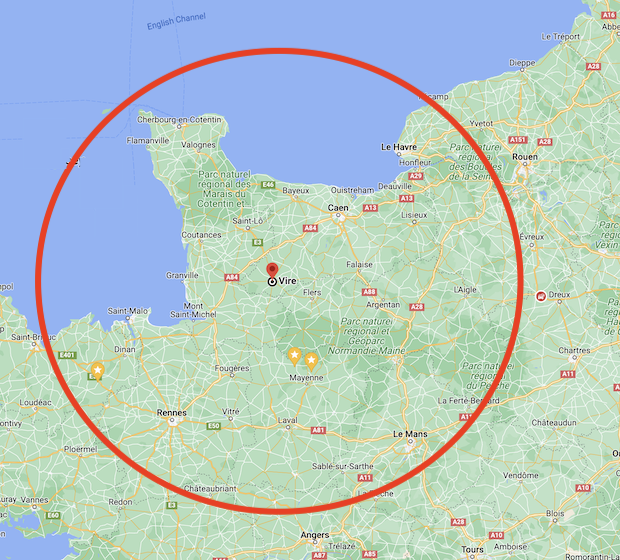

We are very pleased to offer our clients the services of the premier septic tank installation company in Normandy, we fully recommend the expert and friendly help of Michael Miller-Smith at MMS Groundworks.

Michael Miller Smith has extensive knowledge and experience in all manner of groundworks. Starting from an early age (12), and being too young to join in, he would observe his father whilst sitting on their digger. By the time Michael was 19 he was up and running his own business in the north of England.

Due to an early start in the industry, he has a wealth of experience in all aspects of groundworks. Experience that included working with house building companies (e.g. Persimmon Homes) and then subsequently the Environment Agencies to name but a few. Whatever the job in store, you can be rest assured that Michael will know how to tackle it.

Michael decided to move his company to France in 2013 as he realised there was a very important service missing for the British community. Michael set up a company to help install new sanitation systems (a newly deployed law by the French government to update any sanitation system polluting the natural environment) to the many thousands of British property buyers every year.

MMS Groundworks have become a key player within the industry since 2013. Michael (company director) is in control of every aspect at each stage of the process.

MMS Groundworks provide the complete service. From the very complex planning laws and our ability to speak fluently in French, allowing us to liaise with the S.P.A.N.C (Environment Agency) effectively. We have built partnerships with other leading French companies in Normandy which, in turn, provides the highest standards to all of our clients.

Michael’s honest and trustworthy approach ensures his company gets recommended for future jobs by existing satisfied customers. His reputation is of paramount importance and is the main reason MMS Groundworks are the premier septic tank installation company in Normandy, France.

To discuss MMS Groundworks services contact Michael using the form above, so he can start helping you with your enquiry and give you an accurate quote.

Should you wish to have more information in general about anything to do with French Property, we would advise you to Contact Us, so we may best assist you.

The information that you give and that we obtain through you using this website may be used by this Company and by our partner companies only for purposes in connection with your use of this website and for marketing activities of this Company and partner companies. By using this site you confirm your consent to this. If you do not want to receive any marketing information from this Company and/or our partner companies then please notify us.

For everything you need to know about French property for sale visit www.clefrance.co.uk